operating cash flow ratio importance

Operating cash flow is an important metric because it shows investors whether or not a company has enough funds coming in to pay its bills or operating expenses. Its a measure of how much money you are generating from your operations per every dollar in sales you bring in.

Cash Flow From Operations Ratio Formula Examples

Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth.

. In the case of a small business cash is very important for survival. The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a companys operations. Operating cash flow is the amount of cash a business generates from its day-to-day operations within a specific time.

This is because it shows a better ability to cover current liabilities using the money generated in the same period. The operating cash flow ratio is a key metric for assessing a businesss financial health. Operating cash flow ratio CFO Current liabilities A higher ratio is more desirable.

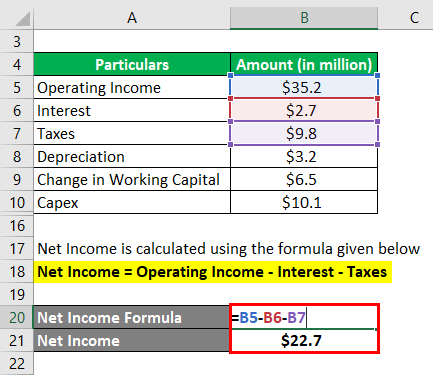

The number is different from net income although it is very similar. Put simply it measures the amount of cash that a business has on hand to meet its current obligations. Operating cash flow is a measure that is used to gauge how much money is flowing into and out of a particular company.

Any value greater than 10 as it means a company can pay off its current short-term liabilities. The Operating Cash Flow Margin also called the Cash Flow Margin or simply the Margin Ratio is one of the most commonly used profitability ratios. An investors perspective is that a low ratio could imply that the company is short on cash flow.

But with so much of your time spent running and growing your business it can be challenging to keep track of just how well your company is doing. The operating cash flow ratio provides a clear financial assessment of your companys needs and. For any business the operating cash flow ratio is an important measure of profitability.

Put another way it shows how efficient or inefficient your company is at transforming operations into cash. If it has a negative operating cash flow it means that the. This ratio can help gauge a companys liquidity.

From there deduct 5000 for a new equipment purchase. For small business owners it is essential. The OCF ratio is 10 because net cash current liabilities.

Cash flow ratios are sometimes reserved for advanced financial analysis. Investors use it as a liquidity metric. Operating cash flow ratio.

Operating Cash Flow 55000. Their cash outflows are 10000 leaving a net cash from operations of 10000. Uses of Operating Cash Flow Ratio It measures the ability of a firm to pay off its immediate debts It gauges the earnings that a company has generated through its functions It helps investors and business analysts to compare competitive businesses with.

So we can see that Radha succeeded in generating 55000 of cash flows from her operations. Cash flow from operating activities CFO is an accounting item that indicates the amount of money a company brings in from ongoing regular business activities such as manufacturing and selling. An operating cash flow ratio less than one indicates that the company is unable to satisfy its existing obligations due to a lack of cash generated by operations.

What is a good operating cash flow ratio. A high ratio indicates that the business is generating enough cash to cover its expenses while a low ratio suggests that the business may be in danger of defaulting on its. Although many investors gravitate toward net.

Operating cash flow OCF is the lifeblood of a company and arguably the most important barometer that investors have for judging corporate well-being. Company A has 20000 a month in cash inflows. Operating Cash Flow Net Income - Changes in Assets and Liabilities Non-Cash Expenses 100000 50000 20000 25000 10000.

It would serve a business owner or manager well to calculate the cash flow ratios in order to have an accurate picture of the actual cash position and viability of the business. Operating Cash Flow vs. This ratio calculates how much cash a business makes as a result of sales.

If a company has a positive operating cash flow this means that it is bringing in more money than it is sending out. A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate.

Price To Cash Flow Formula Example Calculate P Cf Ratio

Free Cash Flow Conversion Fcf Formula And Example Analysis

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio Formula Guide For Financial Analysts

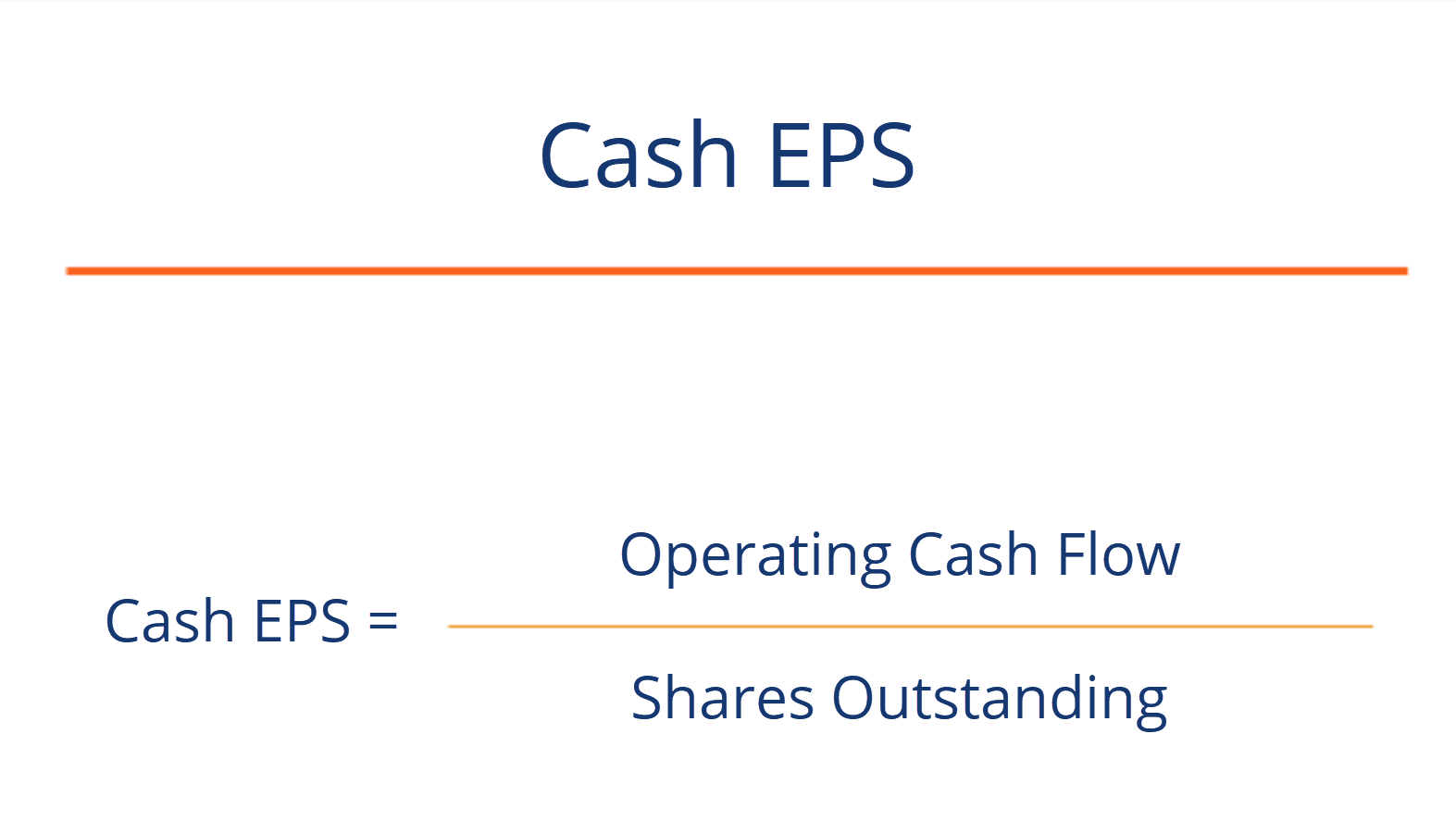

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Price To Cash Flow Ratio P Cf Formula And Calculation

Price To Cash Flow Ratio Formula Example Calculation Analysis

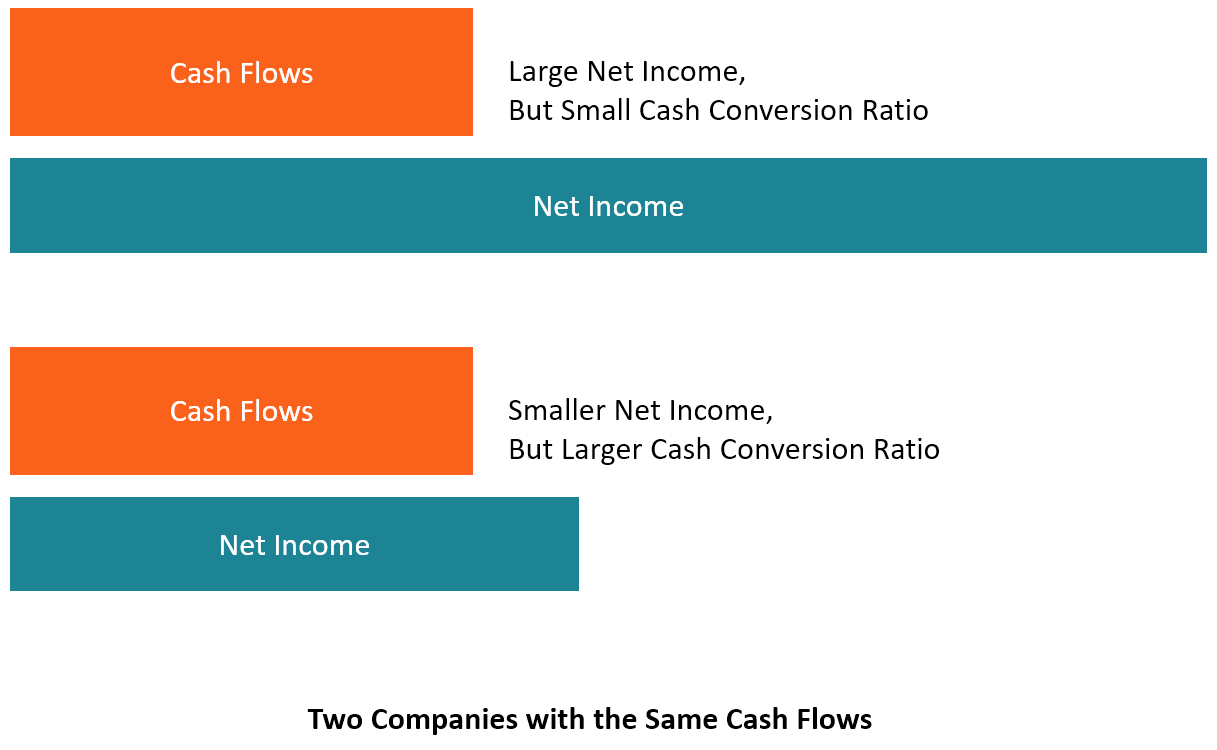

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Ratio Definition Formula Example

Cash Flow Formula How To Calculate Cash Flow With Examples

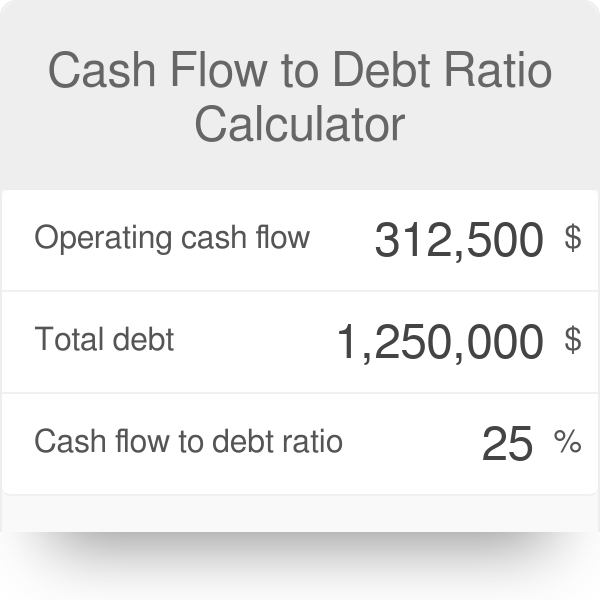

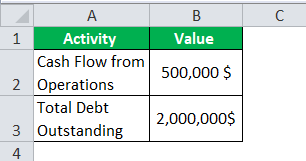

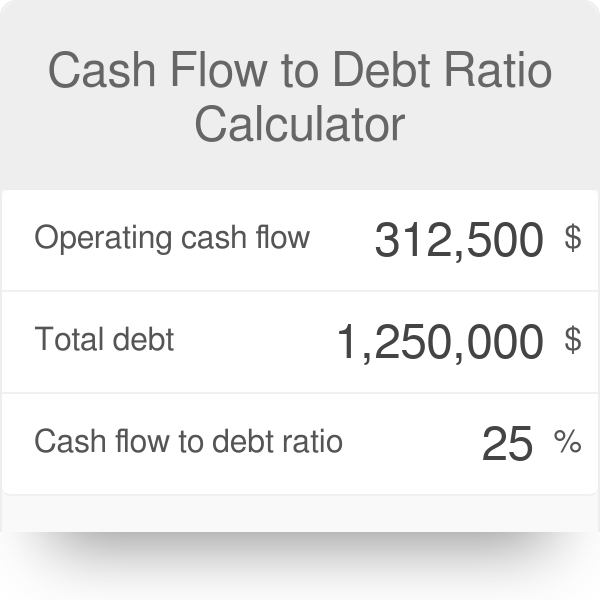

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow To Debt Ratio Calculator

Fcf Formula Formula For Free Cash Flow Examples And Guide

Cash Conversion Ratio Financial Edge

Operating Cash Flow Ratio Calculator

Free Cash Flow Formula Calculator Excel Template